The Downpayment Toward Equity Act also known as the 25000 First-Time Home Buyer Downpayment Grant gives first-time buyers a cash grant up to 25000 toward the purchase of a home. There is no limit on the purchase price for first-time home buyers to receive a refund.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)

Form 5405 First Time Homebuyer Credit And Repayment Of The Credit

Condominium and Cooperative Associations.

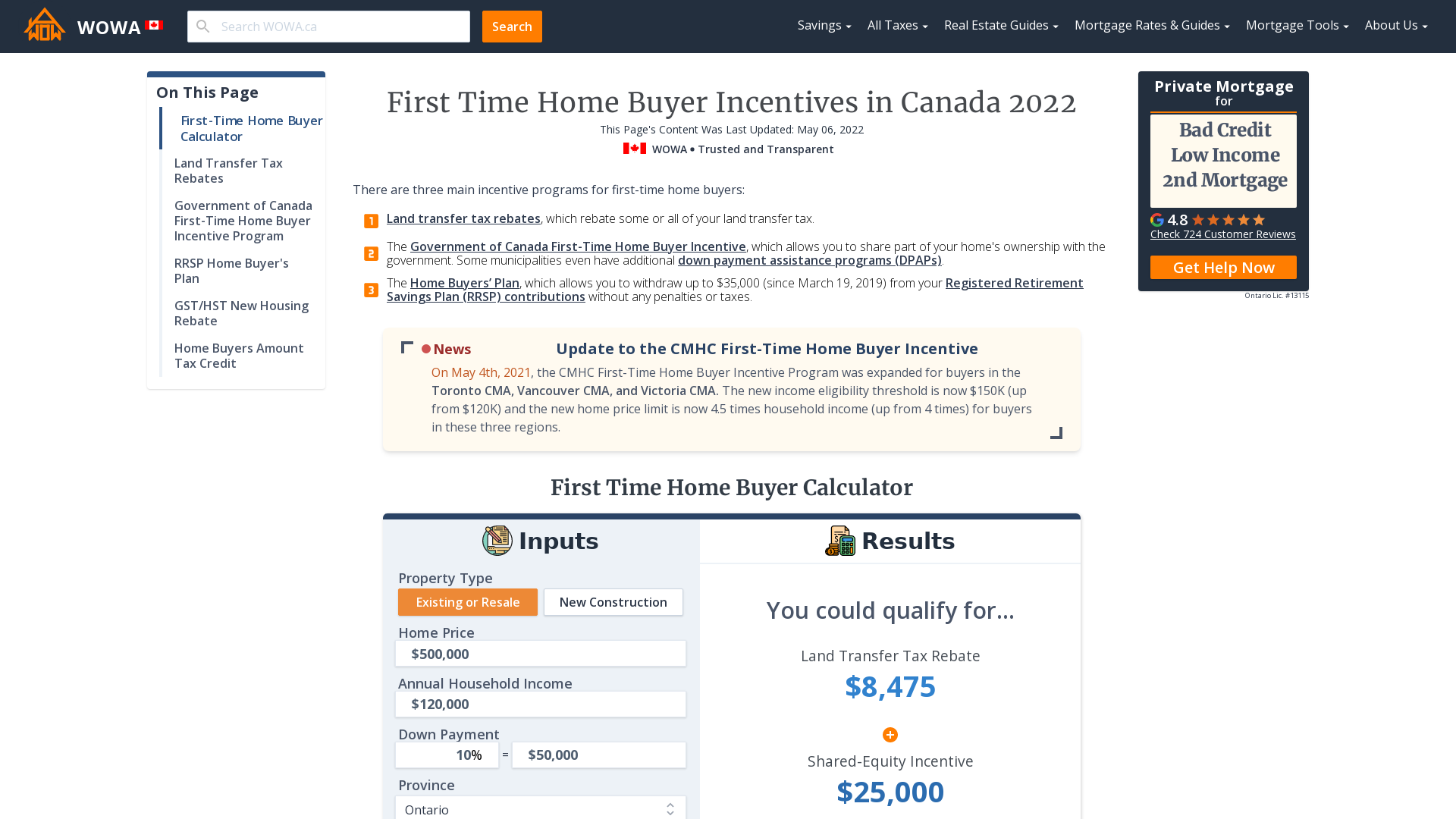

. To qualify youll need to be 18 years or older and not have an ownership interest in a home in the last three years. GST went live in 2016 and the amended model GST law passed in both the house. The 15000 First-Time Home Buyer Tax Credit has precedent which makes it the most likely first-time buyer program to pass Congress.

Democrats rallied behind the 430 billion climate health care and tax overhaul after Senate Majority Leader Charles Schumer D-NY reached a last-minute deal with Sen. But expenditures in 2022 the year after the House bill passed were projected to be less than 6 billion. Prior to 2016 the purchase price limit to be eligible for the refund was 200000.

On top of that in the current form of the discussion draft a home buyer could stack this program with any other assistance programs they might be receiving from other federal state. Yet the implementation of the law delayed as it was not passed in Rajya Sabha. NYPIRGs Fuel Buyers Group brings a collaborative non-profit perspective to the home energy marketplace helping consumers to save money while simultaneously helping to improve the environment.

President Biden signed into law the bipartisan gun bill before leaving for Europe. This bill would bring back the tax credit from 2008 with many of the same requirements. The new gun safety bill would expand that definition to include dating partners.

Ed Markey D-MA shoots a celebratory selfie video with climate activists outside the US Capitol after the Senate passed the Inflation Reduction Act on August 7. These subsidies provided by the federal government to lower premium costs. The first-time home buyer tax credit is automatically for eligible home buyers.

For eligible home buyers the funds under this possible bill can be used as down payment assistance closing cost assistance or even payments to reduce your mortgage interest rate. The Fuel Buyers Group negotiates with home heating providers using the combined purchasing power of our members to get a lower price. The bill stipulates that homebuyers must meet income and home purchase-price limits.

State lawmakers on Tuesday passed a bill that would. God willing its going to save a lot of lives he said. Joe Manchin D-WVa who.

Federal law prevents some convicted domestic abusers from owning a gun depending on their relationship to the victim. Perez Condominium and Cooperative Associations. California could soon become the seventh state to make sure people wont lose their jobs for smoking marijuana outside of work.

The bill for first-time buyers is modeled on the 8000 First-Time Home Buyer Tax Credit from the 2008 Housing and Economic Recovery Act. President Joe Biden is preparing to sign Democrats landmark climate change and health care bill which includes the most substantial federal investment in history to fight climate change. In 2031 they would grow to almost 45 billion.

If passed the bill will extend medical insurance premium subsidies under the Affordable Care Act ACA through 2025. If passed the First-Time Homebuyer Act of 2021 will offer first-time homebuyers a tax credit of up to 15000. Revises provides laws for condominium cooperative associations relating to disciplinary action official records reserve accounts studies milestone inspections transfer of control of association information that.

The First-Time Homebuyer Act of 2021 was introduced by several Democratic members of Congress in April 2021. Non-first-time home buyers are also exempt from PEIs real property transfer tax if the cost of the property being transferred is below 30000. GENERAL BILL by Appropriations Committee.

It would enhance background checks for prospective gun buyers ages 18 to 21 requiring for the first time that juvenile records including mental health records beginning at age 16 be vetted for. The member-owned lender reassured customers it would use the spare capacity to renew its focus on other sectors such as affordable housing and support for first-time buyers. Bill ClarkCQ-Roll Call Inc.

The bill states that cash can be applied to any purchase-related line-item including down payment interest rate reduction mortgage and real estate closing costs and. Military news updates including military gear and equipment breaking news international news and more. Bill Holter is what many of us have known for some time is a geopolitical and financial genius when during his last interview on April 5 2022 with you Greg he said All Putin is saying is I want whats best for Russia Where Putin goes on to say We are going to sell our goods we want to be paid in our currency and we are making it real by basically backing it with.

In 2014 the new Finance Minister at the time Arun Jaitley reintroduced the GST bill in Parliament and passed the bill in Lok Sabha in 2015. The President of India also gave assent.

Thank You Senator Craighead Gene And Arla They Testified In A Hearing Today At The Capitol In Support Of Sen Home Ownership First Time Home Buyers Nebraska

Justin Trudeau Offers No Timeline For First Time Home Buyer Bill Macleans Ca

Before You Move In A Checklist To Save Hassles Later Home Buying Process Buying First Home Buying Your First Home

Buying An Apartment A Handy Checklist For You Roofandfloor Checklist Buying A New Home Say Congratulations

Canada S First Time Home Buyer Incentive What You Need To Know Bmo

0 comments

Post a Comment